To maximise your CPF Special Account just before you turn 55th birthday, you need to invest the money in low cost stable investment.

Two low cost and stable investments you can consider :

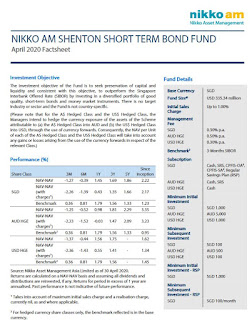

1) Nikko AM Shenton Short Term Bond SGD

https://secure.fundsupermart.com/fsm/funds/factsheet/370332/Nikko-AM-Shenton-Short-Term-Bond-SGD

2) Singapore Government T-Bills (6 Months or 1 Year)

Buy it at a discount. Upon maturity, will then receive the full face value of the bill.

Return depends on market conditions when traded in the exchange

Can invest in the T-bills through

- DBS/POSB, OCBC and UOB ATMs or internet banking

- Invested with your CPFIS fund

No comments:

Post a Comment