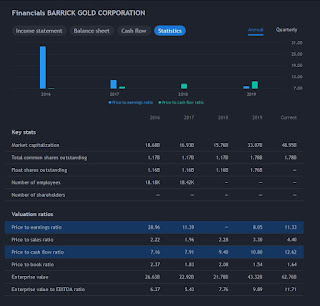

Barrick Gold has sold off $1.5 billion in noncore assets to help reduce its debt, which in the June-ended quarter pushed net debt down by almost 25% to $1.4 billion. Higher gold prices, coupled with Barrick's leverage, should allow the company to deploy its extra cash flow to improve its balance sheet.

Additionally, free cash flow totaled $522 million in the second quarter, an improvement of $84 million on a $128-an-ounce increase in the average price of gold from the sequential first quarter