All rights reserved and actively enforced.

Reprint Policy

A week ago, the Federal Reserve initiated a new program of "quantitative easing" (QE), with the Fed purchasing U.S. Treasury securities and paying for those securities by creating billions of dollars in new monetary base. Treasury bond prices surged on the action. With the U.S. economy predictably weakening, this second round of quantitative easing appears likely to continue. Unfortunately, the unintended side effect of this policy shift is likely to be an abrupt collapse in the foreign exchange value of the U.S. dollar.

How exchange rates are determined - a primer

To understand how currencies fluctuate, it's helpful to understand two forms of "parity" that operate in the foreign exchange markets.

1) Purchasing Power Parity (PPP): This describes the tendency for long-term exchange rate movements to reflect long-term changes in relative price levels between countries. Suppose for simplicity that a given basket of goods costs $10 in the U.S., and costs FC40 in some other country (where FC is simply a unit of foreign currency). If the goods are identical and can be transported costlessly without any barriers, one would expect that $10 = FC40, or that $1 = FC4. So the exchange rate would satisfy purchasing power parity if one dollar traded for 4 units of foreign currency.

Suppose the foreign country is highly inflationary, so that the price of that basket of goods increases to FC60, while the U.S. experiences no corresponding inflation. PPP suggests that the exchange rate should track the relative price levels between the two countries, resulting in a new exchange rate of $1 = FC6. This would be a "strengthening" or "appreciation" in the dollar, since each dollar would command a greater amount of foreign currency. Conversely, this would be a "weakening" or "depreciation" in the foreign currency, since each unit of FC would command fewer dollars.

More generally, goods and services are not identical across countries and cannot be moved costlessly, so PPP is only a long-term tendency, and is not enforced at every point in time. Still, there is a strong tendency for exchange rate movements, in the long run, to reflect relative inflation rates of inflation between countries. Countries with high rates of inflation tend to depreciate over time, relative to countries with lower rates of inflation, and this depreciation is in nearly direct proportion to the relative changes in price levels (particularly when one uses price indices of tradeable goods).

2) Interest Rate Parity: This describes the tendency for exchange rates to move in a way that offsets expected differences in interest rate returns. Suppose that interest rates in the U.S. are 2%, and interest rates in the foreign country are 5%. If the exchange rate was expected to remain perfectly constant, and there were no barriers to capital movements, investors would have a strong tendency to buy the foreign currency in order to earn the higher interest rate. Of course, the exchange rate would not remain constant, as investors would tend to bid up the foreign currency. In fact, there would be a tendency to bid up the foreign currency until it was sufficiently elevated today that a 3% annual depreciation would be expected in the future. At that point investors would be indifferent, since the 2% interest rate available in the U.S. would be equivalent to the 5% interest - 3% depreciation expected in the foreign currency. From a foreigners perspective, the 5% interest rate available in that country would be equivalent to the 2% interest + 3% appreciation expected in the U.S. dollar.

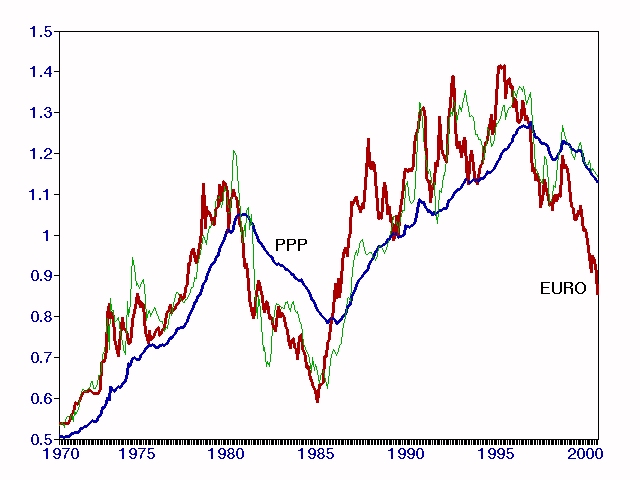

The key idea is that purchasing power parity holds in the long-run in order to align the prices of internationally traded goods and services, while interest rate parity tends to maintain shorter-term equilibrium in the capital markets. Both are important determinants of currency fluctuations because currencies are both a means of payment and a store of value. You can find a practical example of how PPP and interest rate parity combine to determine exchange rates in Valuing Foreign Currencies, published in September 2000. At the time, I argued that the euro, then at $0.85, was deeply undervalued - and included the following chart. The volatile red line is the $/euro exchange rate (data for the German mark is used prior to 1999), the blue line is PPP, and the thin line is our calculation of the value of the euro implied by interest rates as well as price levels.

Since inflation rates as well as nominal interest rates are important in determining exchange rates, one would expect that real, after-inflation rates are also important. Indeed, this is true - and with a little bit of algebra, one can show that a currency should deviate PPP by an amount that reflects the difference in real interest rates expected between the two countries over time. Currencies with relatively high real interest rates will tend to trade well above PPP, while currencies with low or negative real interest rates will tend to trade below their PPP values.

Why quantitative easing is likely to trigger a collapse of the U.S. dollar

Consider a situation in which there is zero anticipated inflation in both the U.S. and in a given foreign country. In this situation, PPP implies a flat long-term profile for exchange rates, because there is no pressure in the goods market for currency values to change over time. Meanwhile, suppose that interest rates (say, on 10-year government notes) in the U.S. and the foreign country are both at 4%. In this situation, an investor in the U.S. expects a 4% return from domestic Treasury notes, and with no expected currency appreciation, also expects a 4% return from investing in the foreign country. In this situation, both PPP and interest rate parity can be satisfied with an exchange rate that simply remains constant.

In contrast, quantitative easing can be expected to create a remarkably different situation. The Fed's purchase of Treasury securities and creation of base money is occurring in an environment where fiscal deficits are already out of control, while two-thirds of the Fed's balance sheet already represents Fannie and Freddie Mac securities that need to be bailed out by the Treasury. This makes it enormously difficult to reverse the Fed's transactions - because the Fed is not simply determining whether a given stock of government liabilities will take the form of Treasury bonds or currency. It is instead effectively printing new money to finance ongoing spending for fiscal deficits and the bailout of the GSEs. At the same time, the fact that it is operating in a weak economy and a near-term deflationary environment means that nominal interest rates are being pressed down at the same time that long-term inflationary prospects are escalating.

From the standpoint of the two parity conditions, the very long-term implication of quantitative easing is a gradual devaluation of the U.S. dollar (an increase in the dollar price $/FC of foreign currency). If this increased inflation risk was reflected in interest rates (so that real interest rates were held constant), the U.S. dollar would simply move along that gradually sloped PPP line, and likewise, foreign currencies would gradually appreciate against the dollar.

However, because of economic weakness and credit strains, coupled with the demand for Treasuries by the Fed, quantitative easing instead moves U.S. interest rates in the opposite direction, falling rather than rising. From the standpoint of interest rate parity, capital market equilibrium then requires the U.S. dollar to depreciate immediately, by a sufficient amount to set up the expectation of future appreciation in order to offset the shortfall of U.S. interest rate returns.

In short, quantitative easing is likely to induce what the late MIT economist Rudiger Dornbusch described as "exchange rate overshooting" - a large and abrupt shift in the spot exchange rate that occurs in order to align long-term equilibrium in the market for goods and services with short-term equilibrium in the capital markets.

This adjustment is depicted in the diagram below. In response to the monetary shock, a modest but long-term depreciation in the dollar (a rise in the U.S. dollar price of foreign currency) is required, depicted by the blue line. However, since nominal interest rates in the U.S. actually decline, ongoing equilibrium in the capital market requires that the U.S. dollar must be expected to appreciate over time by enough to offset the lost interest. As a result, quantitative easing is likely to result in an abrupt "jump depreciation" of the U.S. dollar (that is, a spike in the value of foreign currencies).

Frankly, I've always thought Dornbush's use of the word "overshooting" was unfortunate, because it implies that the exchange rate move is an overreaction, when that is not at all the case. Overshooting refers to the tendency of the spot exchange rate to move beyond its long-term PPP value, but this move is in fact approprate, efficient, and required in order to align the returns that investors can expect in each currency. So it is important to avoid misinterpretation - the policy of quantitative easing is likely to force a large adjustment on the U.S. dollar because the Federal Reserve is choosing to lay a heavier hand on the Treasury bond market than would result from economic conditions alone. The resulting shift in interest rates and long-term inflation prospects combine to dramatically reduce the attractiveness of the U.S. dollar. A significant and relatively abrupt devaluation is then required, in an amount sufficient to set up expectations of a U.S. dollar appreciation over time.

Just to avoid misinterpretation, I am not suggesting that there is a near-term risk of inflation, nor am I suggesting that quantitative easing is inflationary per se. The primary driver of long-term inflation pressure has always been, and continues to be, growth in the total quantity of government liabilities (both monetary base and government debt) for purposes that do not expand the productive capacity of the economy. This total quantity is determined by fiscal policy, and the form of those liabilities hardly matters because currency and government debt are close substitutes in the portfolios of individuals. So the argument here is not that quantitative easing will create inflation which will hurt the dollar. The argument is more subtle. It is that we are running a fiscal policy that is long run (though not short-run) inflationary, and that the monetary policy of quantitative easing prevents longer term interest rates from acting as an adjustment variable, since the Fed is essentially announcing that it will lean on the Treasury bond market. By suppressing Treasury yields, the Fed forces the exchange rate to bear the full weight of the adjustment.

Importantly, the Fed's policy need not suppress real interest rates by more than a percent or two to create dramatic pressure on the dollar. One way to think about the price jump required by exchange rate overshooting is to think about a long-term bond. If a 10-year zero-coupon bond with a $100 face is priced to deliver 0% annually, it will have a price of $100. If investors suddenly demand the bond to be priced to deliver 2% annually, the bond must experience an immediate drop in price to $82. Once that price drop occurs, the selling pressure on the bond will abate, since it will now be expected to appreciate at a 2% annual rate.

My impression is that Ben Bernanke has little sense of the damage he is about to provoke. A central banker who talks about throwing money from helicopters is not only arrogant but foolish. Nearly a century ago, the great economist Ludwig von Mises observed that massive central bank easing is invariably a form of cowardice that attempts to avoid the need to restructure debt or correct fiscal deficits, avoiding wiser but more difficult choices by instead destroying the value of the currency.

Von Mises wrote, "A government always finds itself obliged to resort to inflationary measures when it cannot negotiate loans and dare not levy taxes, because it has reason to fear that it will forfeit approval of the policy it is following if it reveals too soon the financial and general economic consequences of that policy. Thus inflation becomes the most important psychological resource of any economic policy whose consequences have to be concealed; and so in this sense it can be called an instrument of unpopular, that is, of antidemocratic policy, since by misleading public opinion it makes possible the continued existence of a system of government that would have no hope of the consent of the people if the circumstances were clearly laid before them. That is the political function of inflation. When governments do not think it necessary to accommodate their expenditure and arrogate to themselves the right of making up the deficit by issuing notes, their ideology is merely a disguised absolutism."

As a side note, von Mises also cautioned against the misconception that destroying the value of a currency would have a sustainable benefit for the economy, writing "If the depreciation is desired in order to 'stimulate production' and to make exportation easier and importation more difficult in relation to other countries, then it must be borne in mind that the 'beneficial effects' on trade of the depreciation of money only last so long as the depreciation has not affected all commodities and services. Once the adjustment is completed, then these 'beneficial effects' disappear. If it is desired to retain them permanently, continual resort must be had to fresh diminutions of the purchasing power of money."

Market Climate

As of last week, the Market Climate for stocks was characterized by unfavorable valuations, unfavorable market action, and unfavorable economic pressures. I've noted for weeks that the damage to market action was not quite to the level that would create urgent downside concerns. However, the deterioration we observed last week suggests a more urgent shift to defensive positioning. For our part, the Strategic Growth Fund remains fully hedged at present.

In bonds, the Market Climate was characterized last week by unfavorable yield levels but favorable yield pressures. Treasury securities have advanced sharply on the initial quantitative easing purchases by the Fed. Meanwhile, the jump in unemployment claims to 500,000 and the surprising drop in the Philadelphia Fed index are both consistent with the weakening economic conditions that are clearly implied by leading measures. If anything, those deteriorations appear to be early, not late-stage observations. As I've noted regularly in recent commentaries, normal lead-times would suggest a deterioration in the ISM Purchasing Managers Index in the August-September data, while new claims for unemployment typically have an even longer lag, which would normally make us expect strains closer to October. Suffice it to say that the much earlier deterioration in economic measures is not encouraging, but it also opens up the possibility that we may see some misleading "improvement" in the data in the next few weeks before we get into the more typical window of deterioration.

As one might infer from the content of this week's remarks, my view is that the quick initiation of quantitative easing by the Federal Reserve has significantly changed the prospects for foreign currencies and by extension, precious metals. For the past couple of months, I've observed that deflation risks in response to fresh economic weakness were likely to provoke weakness in the commodity area, even if long-term inflationary concerns were accurate. However, my impression is that the Fed's immediate initiation of quantitative easing may cause investors to take deflation concerns "off the table." This is important, because even as we observe economic deterioration, the potential for a "deflationary scare" is likely to be more muted than we might have expected without explicit quantitative easing actions.

This doesn't entirely remove those risks, of course, particularly if we begin to observe a spike in credit spreads (which would be associated with default concerns and a likely drop in monetary velocity), but it clearly changes the environment. Gold stocks and the XAU have essentially gone nowhere since May. Last week, in response to a favorable shift in the Market Climate for precious metals and currencies (largely resulting from the shift in Fed policy and interest rates), we increased our exposure to precious metals in the Strategic Total Return Fund toward 10% of assets, and raised our exposure to foreign currencies to about 5% of assets. This is still not an aggressive stance, and we would prefer the opportunity to accumulate a larger exposure on substantial price weakness, if it occurs. But as this week's comment makes clear, the Federal Reserve has begun to play with fire, the effects of which I doubt Bernanke fully appreciates.

Good policy is not rocket science. It begins with the refusal to make people pay for mistakes that are not their own. This economy continues to struggle with a fundamental problem, which is that debt obligations exceed the ability to service them. While policy makers have done everything to preserve the patterns of spending and consumption that created the problem in the first place, we have done nothing to restructure those obligations.

To the extent that we observe fresh credit problems, we should not pursue the same policies. Instead, we should focus on restructuring debt. Let the bank bondholders fail, and defend depositors and customers through the standard procedures that the FDIC has followed for decades. Deal with the debt of Fannie Mae and Freddie Mac by asserting that there is no explicit government guarantee, and let the holders of the mortgage pools receive precisely what they are entitled to receive without public funds. At the same time, expand the role of the FHA to provide explicit government guarantees for future mortgages in return for actuarily fair risk-based premiums, and require mortgage originators to retain a piece of the mortgage loan, along with appropriate capital requirements, and the stipulation that this retained portion bears the first loss if the mortgage goes bad. Finally, refuse to trot self-interested bank and Wall Street executives in front of the public to extort the nation through fear of the word "failure." Banks fail all the time and customers don't lose a cent. The only implication of failure is that stock and bondholders of reckless institutions aren't rewarded for their malinvestment at public expense.---

Prospectuses for the Hussman Strategic Growth Fund and the Hussman Strategic Total Return Fund, as well as Fund reports and other information, are available by clicking "The Funds" menu button from any page of this website.

No comments:

Post a Comment