Follow up on NZDJPY 4H TRADE CALL

68.19 Proven is a strong support. NJ still trading in range.

My Current Investments

Main Labels:

1) Gold (Link for Gold posts)

2) Silver (Link for Silver posts)

3) AUDSGD (Link for AUD posts)

4) CNYSGD Closed TP 0.208 ( Link for CNYSGD posts)

5) Fullerton SGD Heritage Income Class B ( Link )

6) Global X Uranium ETF Long ( Link )

7) US Stock Trade (Link)

Disclaimer :

None of the information contained in this Blog or Video constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investments, or to participate in any particular trading strategy.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The author is not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here.

Next Market Crash Stocks Accumulate LIst

Intrinsive Value Tracking

Wednesday, July 01, 2020

AUDUSD 4H TRADE CALL -- Update

Follow-up on AUDUSD 4H TRADE CALL

Price remain stay above the strong support 0.68. AUDUSD still trading in range.

Price remain stay above the strong support 0.68. AUDUSD still trading in range.

Monday, June 29, 2020

Questions And Answers from CPF You Should Know Before You Turn Age 55

Following are the Questions And Answers from CPF You Should Know Before You Turn Age 55 :

1) When we just past 55 years old, assuming the we have invested the Special Account money and left min of $40K before 55, will the $40k left in the SA be transferred to RA ?

From CPF : Yes the 40K from SA will be transferred to RA. CPF will auto transfer from SA follow by your OA to meet the FRS, e,g $192k(Y2022) Not ERS $288k(Y2022)

2) If question one is true, any cash out request, the amount will be drawn from the OA instead of SA since SA is empty ?

From CPF : Yes, Any cash out request after 55 need to drawn out from the SA first till SA is empty, follow by OA.

3) Can we specify to invest Annuity Plan/Approved funds from OA instead of SA, and have cash payout to our bank after age 55 ( For Annuity Plan) ?

From CPF : Yes, You can invest Annuity Plan/Approved funds from OA or SA as long as it higher than the min sum, OA min sum is $20k and SA $40k as of Y2020.

The cash payout from your Annuity Plan can pay to your bank instead of back to CPF if you have applied online to close your investment after you invested the annuity.

4) At age 55, what will be the procedure to ensure that the full ERS is being transferred to RA is this is our desire ?

From CPF : You can transfer your money from OA or cash top up your RA to max ERS after age 55 any time..

6) Assuming that we have full ERS of $271500 in RA when we passed age 55, what would be the actual sum when we reach age 65 ? It is based on first 30K at 6%, 2nd 30K at 5% & the remaining at 4% compound over 10 years ?

From CPF : Correct, It is based on first 30K at 6%, 2nd 30K at 5% & the remaining at 4% compound over 10 years.

If you executed my earlier post of How-to-maximise-your-special-account.html,

And

Prefer to cash out some money from your CPF, you should cash out from OA before your sell your SA investment and let your money flow back to SA. As any cash out request after 55 need to drawn out from the SA first till SA is empty, follow by OA.

1) When we just past 55 years old, assuming the we have invested the Special Account money and left min of $40K before 55, will the $40k left in the SA be transferred to RA ?

From CPF : Yes the 40K from SA will be transferred to RA. CPF will auto transfer from SA follow by your OA to meet the FRS, e,g $192k(Y2022) Not ERS $288k(Y2022)

2) If question one is true, any cash out request, the amount will be drawn from the OA instead of SA since SA is empty ?

From CPF : Yes, Any cash out request after 55 need to drawn out from the SA first till SA is empty, follow by OA.

3) Can we specify to invest Annuity Plan/Approved funds from OA instead of SA, and have cash payout to our bank after age 55 ( For Annuity Plan) ?

From CPF : Yes, You can invest Annuity Plan/Approved funds from OA or SA as long as it higher than the min sum, OA min sum is $20k and SA $40k as of Y2020.

The cash payout from your Annuity Plan can pay to your bank instead of back to CPF if you have applied online to close your investment after you invested the annuity.

4) At age 55, what will be the procedure to ensure that the full ERS is being transferred to RA is this is our desire ?

From CPF : You can transfer your money from OA or cash top up your RA to max ERS after age 55 any time..

6) Assuming that we have full ERS of $271500 in RA when we passed age 55, what would be the actual sum when we reach age 65 ? It is based on first 30K at 6%, 2nd 30K at 5% & the remaining at 4% compound over 10 years ?

From CPF : Correct, It is based on first 30K at 6%, 2nd 30K at 5% & the remaining at 4% compound over 10 years.

If you executed my earlier post of How-to-maximise-your-special-account.html,

And

Prefer to cash out some money from your CPF, you should cash out from OA before your sell your SA investment and let your money flow back to SA. As any cash out request after 55 need to drawn out from the SA first till SA is empty, follow by OA.

Sunday, June 28, 2020

Why US Market Sitill Not In Bull Market

From 26-Jun Breakfast With Dave ;

From last market plunge on Jun 11th , every day VIX has closed above 30 ( At 32 currently ). This is red flag as from the above table, When the VIX is over 25, the stock market tends to Drift lower over time..

With VIX currently at 32, the average monthly S&P 500 monthly change is Negative 1.1%.

From last market plunge on Jun 11th , every day VIX has closed above 30 ( At 32 currently ). This is red flag as from the above table, When the VIX is over 25, the stock market tends to Drift lower over time..

With VIX currently at 32, the average monthly S&P 500 monthly change is Negative 1.1%.

Friday, June 26, 2020

NU 15Min Trade Call - Update Closed

Thursday, June 25, 2020

CPF SPECIAL ACCOUNT APPROVED FUNDS

Following are the CPF Special Account Approved Fund :

- Eastspring Investments Unit Trusts - Asian Balanced SGD

- Eastspring Investments Unit Trusts - Singapore Select Bond A SGD

- Eastspring Investments Unit Trusts - Singapore Select Bond AD SGD

- FTIF - Templeton Global Balanced AS Acc SGD (CPF)

- First State Bridge A DIS SGD

- Legg Mason Western Asset - Global Bond Trust A Acc SGD

- Legg Mason Western Asset - Singapore Bond A Acc SGD

- LionGlobal Short Duration Bond Cl A Dis SGD

- LionGlobal Singapore Fixed Income Investment A SGD

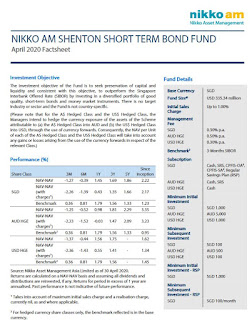

- Nikko AM Shenton Short Term Bond SGD

- Schroder Asian Investment Grade Credit A SGD

- Schroder Multi-Asset Revolution A Dis SGD

- Schroder Singapore Fixed Income A Acc SGD

- United SGD Fund Cl A Acc SGD

- United Singapore Bond Fund SGD

Note : Bold with larger font size are low risk funds

Wednesday, June 24, 2020

How to Maximise Your Special Account Money before You Turn 55

To maximise your CPF Special Account just before you turn 55th birthday, you need to invest the money in low cost stable investment.

Two low cost and stable investments you can consider :

1) Nikko AM Shenton Short Term Bond SGD

https://secure.fundsupermart.com/fsm/funds/factsheet/370332/Nikko-AM-Shenton-Short-Term-Bond-SGD

2) Singapore Government T-Bills (6 Months or 1 Year)

Buy it at a discount. Upon maturity, will then receive the full face value of the bill.

Return depends on market conditions when traded in the exchange

Can invest in the T-bills through

- DBS/POSB, OCBC and UOB ATMs or internet banking

- Invested with your CPFIS fund

Sunday, June 21, 2020

When To Long/Invest STI Index ( Technical Analysis )

Subscribe to:

Comments (Atom)