My Current Investments

Next Market Crash Stocks Accumulate LIst

Intrinsive Value Tracking

Friday, June 19, 2020

Another Good Approach : When To invest S&P 500 ?

Conclusion from the chart, whenever markets have declined over 30% from the 3 years moving average ( Green Color ), that has usually been a very good buying opportunity

Wednesday, June 17, 2020

When to Invest S&P 500 ?

Follow up from my following last post :

http://jimmytradingroom.blogspot.com/2020/06/is-s-500-over-price.html

If you invested S&P 500 at current Price 3114, based on above table historical performance, your investment both Avg 5 Years and 10 Years return likely will be Negative !

Good time to start invest in S&P500 is when PE is less than 20.

Tuesday, June 16, 2020

When To Sell Your Bond Investment ?

Monday, June 15, 2020

Are We In a Recession or a Depression?

- A recession is the part of the business cycle that cleans the system from the excesses of the previous expansion. And a recession usually last only less than one year, and it does not really change the thinking and behavior of the economic subjects.

- A depression is different . A depression lasts longer than one year and it goes deeper. In depression there is a secular changes in consumer spending and saving, and deflation usually follow by stagflation

- From the early 50s to the early 90s, the world population between zero and 65 years old grew by about 25 million per year. We declined to zero in 2018. Now we are negative and it will be shrinking down to 12 million negative growth into the early 2030’s.This creates a much different background for economic growth than what we had previously.

- The corporate sector that has more debt than ever around the world, they had to borrow to pay all the expenditures. The deficit is the US was about $500 billion last year. Corporations now they have to repair the balance sheet. Richard Koo called it the Balance Sheet recession when Japan entered the Big Depression in 1990

Sunday, June 14, 2020

NZDJPY 4H TRADE CALL

NZDUSD 4H TRADE CALL

AUDUSD 4H TRADE CALL

Is S&P 500 Over Price ?

Is S&P 500 Over Price ? Let do a Simple Analysis:

Following is a history of earning from NYU published the chart below on Jan 5, 2020. Please take note Y2019 actual earning is $139.4 and not $162.35 the forecast predicted

What happen in 2008 subprime crisis ? it drop from $82.54 to $42.51...33.9% !

This year most likely it will drop more than Y2008 33.9%, but let assume we just use 33.9% drop from Y2019 earning of $139.4 to estimate this year earning.

The projected this year earning will be $139.4 - ($139.47*33.9%) = $92.3

Refer to the S&P 500 PE Ratio - 90 Year Historical Chart,

Let use 14 PE to estimate the S&P 500 fair value.. 14*92.3 = 1292.

Today S&P 500 Price 3041

You can estimate S&P 500 next year earning and PE, and decide yourself at what price you think is value investing..

S&P 500 PE Ratio - 90 Year Historical Chart

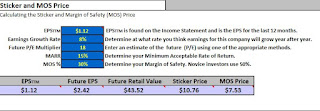

OCBC BANK Margin Of Safety (MOS) PRICE

MOS PRICE $7.53 ( Y2019 Tangible Book Value $9.74 )

OCBC Bank 5 years Tangible Book Value Growth Rate is 8.45%

Risk :

- Can OCBC bank sustains the last 5 years book value growth rate of 8.45% ?

- OCBC Bank last 5 Years EPS growth is only 1.73% vs UOB 5.18%, and DBS Bank 8.92%

- How Blockchain technology impact future banking revenue ........etc