My Current Investments

Main Labels:

1) Gold (Link for Gold posts)

2) Silver (Link for Silver posts)

3) AUDSGD (Link for AUD posts)

4) CNYSGD Closed TP 0.208 ( Link for CNYSGD posts)

5) Fullerton SGD Heritage Income Class B ( Link )

6) Global X Uranium ETF Long ( Link )

7) US Stock Trade (Link)

Disclaimer :

None of the information contained in this Blog or Video constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investments, or to participate in any particular trading strategy.

Any expression of opinion (which may be subject to change without notice) is personal to the author and the author makes no guarantee of any sort regarding the accuracy or completeness of any information or analysis supplied.

The author is not responsible for any loss arising from any investment based on any perceived recommendation, forecast, or any other information contained here.

Next Market Crash Stocks Accumulate LIst

Intrinsive Value Tracking

Thursday, October 01, 2020

Silver Current Bull Run, Will History Repeat?

Wednesday, September 30, 2020

Sunday, September 27, 2020

Great Opportunity to follow Warren Buffett to invest in Barrick GOLD !!!

Barrick Gold has sold off $1.5 billion in noncore assets to help reduce its debt, which in the June-ended quarter pushed net debt down by almost 25% to $1.4 billion. Higher gold prices, coupled with Barrick's leverage, should allow the company to deploy its extra cash flow to improve its balance sheet.

Additionally, free cash flow totaled $522 million in the second quarter, an improvement of $84 million on a $128-an-ounce increase in the average price of gold from the sequential first quarter

Saturday, September 26, 2020

Positive News for China Bonds and Yuan

CNYSGD HIT 0.2016 (Update from 6 Sep Post Is Time To Accumulate CNYSGD)

Wednesday, September 23, 2020

SWITCH INC (SWCH) Both Price Action Analysis and Long Term Fundamental Look Great !!!

SWITCH INC (SWCH)

Both Price Action Analysis and Long Term Fundamental Look Great at current Price.

Price Action Analysis

Fundamental Analysis

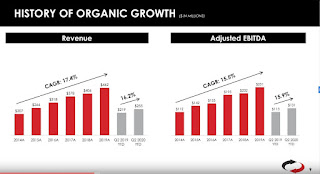

1) More than 15% Growth Rate Per Year

2) Good Financial Model

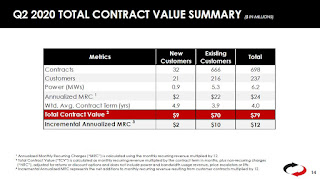

3) Improved Contract Term (Years) For New Customers

4) Divers Customer Base

5) Well Position for Future Growth

Tuesday, September 22, 2020

ILLUMINE INC Technical Analysis

Monday, September 21, 2020

USDJPY Trade Call Update - HIT THE Target !!!

Subscribe to:

Comments (Atom)